Are you looking for an USDA Loan in Texas, but just not sure what a USDA loan even is, how it works, or what it’s even about?

Well looks like you’re in luck today.

We are one of Texas’s leading USDA lenders that specialize in providing FREE USDA mortgage advice and information to folks looking to learn more about how USDA loans work.

Whether you are looking to learn more about how much you can get approved for or already have a USDA mortgage and need to refinance out of your high interest rate loan, we’re here to help you every step of the way!

Checking USDA home loan eligibility is fast, 100% free, and takes less than 30 seconds!

We don’t check credit or need your social security number in order to get started.

How Can a USDA Loan Help You?

If you are someone looking to buy a home but do not have the minimum down payment requirement with other types of mortgages out there, then a Texas USDA home loan may be for you.

USDA loans in Texas are offered to help lower to moderate income households purchase homes in rural areas and in some cases on the outskirts of a city or in a medium sized town as determined by the United States Department of Agriculture (USDA) with no down-payment needed!

In Texas, a USDA loan offers many advantages to qualified borrowers looking to buy or refinance (no cash out) including:

- 100% financing

- Very small monthly mortgage insurance

- No asset requirements

- Gifts allowed for closing costs

- Required property improvements can be financed into the loan up to 102% of the “improved” value, which can be completed after closing.

We offer amazingly low USDA interest rates and competitive closing costs when it comes to helping you buy a home that keeps things easy on the wallet.

We look forward to answering all your questions and are here for you every step of the way.

USDA/FDA Loans

We specialize in servicing first time home buyers looking for a USDA mortgage loan in Texas. A USDA mortgage offers many advantages, as it is very popular with first time homeowners, so you should expect lower interest rates and no down payment in relation to a conventional residential home loan.

In 2024, owning a home is a huge responsibility which shouldn’t be taken lightly when you’re looking at FDA loans. There is a lot to learn before you dive right in, although the first step is often to get approved for FDA home loans. People who have taken mortgage in the past have contributed their knowledge to this article so you can learn how to avoid the mistakes they’ve made, so read on about the rural development direct loan program.

100% Financing

USDA loans may be for up to 100 percent (102 percent if the guarantee fee is included in the loan) of whatever the home appraises for. With this no down-payment option, USDA loans have become a very popular option for those that do not have enough saved up for other types of mortgage financing that is required.

Low, Fixed Rates

USDA mortgages come in one size only – fixed rates. The rates are the same or even better as if you were putting 20% down on the home.

Funds for Closing

Another great feature that comes along with USDA financing is that you can roll everything into the loan. This means you can include closing costs, the guarantee fee, title service fees, and other prepaid items, as long as the appraised value is higher than sales price. The way this is done is by having the sellers raising the sales price by a certain percentage, and then giving it back to you to help contribute to your closing costs.

Occupancy

USDA home loans are only for primary residences. All buyers must personally occupy the dwelling following the purchase.

Refinance Options

If you are wanting to refinance into a USDA loan, you must have an existing USDA Rural Development Guaranteed housing loans or our Section 502 Direct housing loans already in place. For example, you cannot refinance into a USDA loan if you currently have an FHA loan.

Guarantee Fee

There is a one-time guarantee fee that is charged to the lender, which in turn, is rolled into the loan. This is what is called the USDA Guarantee fee and what helps keep USDA in business and offering this great program.

If you are looking for an Austin USDA Lender, Houston USDA Lender, Dallas USDA Lender, or San Antonio USDA Lender, you have come to the right place!

USDA Loan Limits 2024

These are the loan limits for the USDA direct program. Please keep in mind that these are if you go with USDA directly, but if you go with a USDA approved lender such as us, these limits are much much higher because the lender is assuming the risk instead of USDA themselves.

To put things in perspective, USDA lenders like us can do loan amounts over $400,000 whereas if you decide to go with the USDA direct mortgage loan program, you will be capped at these limits below.

Here are all the counties and cities sorted out for you nice and neatly.

| Texas County | USDA Loan Limits 2024 |

|---|---|

| Anderson County, Texas | $104,400 |

| Andrews, Texas | $110,500 |

| Angelina County, TX | $124,200 |

| Aransas County | $134,100 |

| Archer County, TX | $133,200 |

| Armstrong County | $121,900 |

| Atascosa County | $142,300 |

| Austin County, TX | $147,600 |

| Bailey, Texas | $129,000 |

| Bandera County, TX | $131,600 |

| Bastrop County, TX | $144,500 |

| Baylor County, TX | $125,800 |

| Bee County | $128,100 |

| Bell County, TX | $111,500 |

| Bexar County | $143,500 |

| Blanco County, TX | $137,300 |

| Borden, Texas | $110,500 |

| Bosque County, TX | $125,200 |

| Bowie County | $134,300 |

| Brazoria County | $134,000 |

| Brazos County, TX | $162,500 |

| Brewster County TX | $135,200 |

| Briscoe County | $124,200 |

| Brooks County, TX | $121,300 |

| Brown County, TX | $118,800 |

| Burleson County, TX | $140,800 |

| Burnet County, TX | $117,500 |

| Caldwell County | $149,700 |

| Calhoun | $132,000 |

| Callahan County, TX | $121,000 |

| Cameron County | $133,900 |

| Camp County | $131,300 |

| Carson County | $127,400 |

| Cass County | $131,300 |

| Castro County | $116,900 |

| Chambers County, TX | $138,000 |

| Cherokee | $130,200 |

| Childress County | $127,200 |

| Clay County, Texas | $122,300 |

| Cochran, Texas | $129,000 |

| Coke County, TX | $118,600 |

| Coleman County, TX | $115,800 |

| Collin County, TX | $146,700 |

| Collingsworth County | $116,900 |

| Colorado County, TX | $140,300 |

| Comal County | $162,500 |

| Comanche County, TX | $118,300 |

| Concho County, TX | $129,200 |

| Cooke County, TX | $135,700 |

| Coryell Co, TX | $128,500 |

| Cottle, Texas | $114,700 |

| Crane County TX | $126,600 |

| Crockett County TX | $129,200 |

| Crosby, Texas | $129,000 |

| Culberson County | $136,100 |

| Dallam County | $120,900 |

| Dallas County, TX | $134,300 |

| Dawson, Texas | $114,700 |

| Deaf Smith County | $123,900 |

| Delta County | $128,800 |

| Denton County, TX | $135,200 |

| DeWitt | $132,000 |

| Dickens, Texas | $129,000 |

| Dimmit County, TX | $146,500 |

| Donley County | $122,200 |

| Duval County | $121,700 |

| Eastland County, TX | $131,700 |

| Ector County TX | $141,600 |

| Edwards County, TX | $115,900 |

| Ellis County | $143,000 |

| El Paso | $113,000 |

| Erath County | $133,000 |

| Falls County, Texas | $103,500 |

| Fannin County, TX | $128,300 |

| Fayette County, TX | $138,400 |

| Fisher County, TX | $121,000 |

| Floyd, Texas | $129,000 |

| Foard County, TX | $123,200 |

| Fort Bend County | $136,000 |

| Franklin County | $129,300 |

| Freestone County, Texas | $104,400 |

| Frio County | $121,700 |

| Gaines, Texas | $114,700 |

| Galveston County | $131,000 |

| Garza, Texas | $129,000 |

| Gillespie County, TX | $166,000 |

| Glassock County TX | $130,600 |

| Goliad | $132,000 |

| Gonzales County | $138,800 |

| Gray County | $128,400 |

| Grayson County TX | $139,400 |

| Gregg | $135,300 |

| Grimes County | $134,200 |

| Guadalupe County | $150,900 |

| Hale, Texas | $132,800 |

| Hall County | $122,200 |

| Hamilton County, TX | $105,700 |

| Hansford County | $119,400 |

| Hardeman County, TX | $123,200 |

| Hardin County, TX | $128,000 |

| Harris County, TX | $167,900 |

| Harrison | $133,600 |

| Hartley County, TX | $129,400 |

| Haskell County, TX | $121,400 |

| Hays County | $149,700 |

| Hemphill County, TX | $131,400 |

| Henderson County | $129,200 |

| Hidalgo County, TX | $132,600 |

| Hill County, TX | $125,200 |

| Hockley, Texas | $129,000 |

| Hood County | $143,000 |

| Hopkins County | $132,300 |

| Houston County, TX | $139,700 |

| Howard, Texas | $114,700 |

| Hudspeth County | $137,900 |

| Hunt County TX | $137,600 |

| Hutchinson County, TX | $122,900 |

| Irion County, TX | $129,200 |

| Jack County, TX | $122,300 |

| Jackson | $132,000 |

| Jasper County, TX | $105,700 |

| Jeff Davis County TX | $141,100 |

| Jefferson County, TX | $129,000 |

| Jim Hogg County, TX | $121,300 |

| Jim Wells County | $130,600 |

| Johnson County | $143,000 |

| Jones County, TX | $122,000 |

| Karnes County | $144,000 |

| Kaufman County | $139,800 |

| Kendall County, TX | $181,400 |

| Kenedy County | $100,700 |

| Kent County, TX | $120,400 |

| Kerr County, TX | $132,400 |

| Kimble County, TX | $128,300 |

| King, Texas | $129,000 |

| Kinney County, TX | $115,900 |

| Kleberg County | $130,600 |

| Knox County, TX | $121,400 |

| Lamar County | $132,300 |

| Lamb, Texas | $132,800 |

| Lampasas County, TX | $110,400 |

| La Salle County | $132,800 |

| Lavaca | $132,000 |

| Lee County, TX | $140,000 |

| Leon County, TX | $143,200 |

| Liberty County, TX | $145,500 |

| Limestone County, Texas | $104,400 |

| Lipscomb County, TX | $116,600 |

| Live Oak County | $121,700 |

| Llano County, TX | $129,300 |

| Loving County TX | $120,900 |

| Lubbock, Texas | $129,000 |

| Lynn, Texas | $129,000 |

| McCulloch County, TX | $127,700 |

| McLennan County, TX | $134,300 |

| McMullen County | $115,800 |

| Madison County, TX | $143,200 |

| Marion | $130,700 |

| Martin, Texas | $110,500 |

| Mason County, TX | $128,300 |

| Matagorda | $133,900 |

| Maverick County, TX | $145,100 |

| Medina County, TX | $133,300 |

| Menard County, TX | $124,300 |

| Midland County TX | $140,600 |

| Milam County, TX | $105,500 |

| Mills County, TX | $103,200 |

| Mitchell County, TX | $122,900 |

| Montague County, TX | $146,600 |

| Montgomery County, TX | $161,500 |

| Moore County, TX | $136,900 |

| Morris County | $131,300 |

| Motley, Texas | $129,000 |

| Nacogdoches County, TX | $124,200 |

| Navarro County, Texas | $134,300 |

| Newton County, TX | $102,600 |

| Nolan County, TX | $122,400 |

| Nueces County, TX | $130,600 |

| Ochiltree County | $131,400 |

| Oldham County | $131,900 |

| Orange County, TX | $129,000 |

| Palo Pinto County, TX | $133,000 |

| Panola | $129,800 |

| Parker County, TX | $143,000 |

| Parmer County | $119,400 |

| Pecos County TX | $135,600 |

| Polk County, TX | $105,700 |

| Potter County, MSA | $153,600 |

| Presidio County TX | $140,900 |

| Rains County | $137,600 |

| Randall County MSA | $153,600 |

| Reagan County TX | $129,200 |

| Real County, TX | $115,900 |

| Red River County | $128,800 |

| Reeves County TX | $126,600 |

| Refugio County | $130,000 |

| Roberts County | $120,600 |

| Robertson County | $128,500 |

| Rockwall County | $152,700 |

| Runnels County, TX | $118,600 |

| Rusk | $136,500 |

| Sabine County, TX | $102,600 |

| San Augustine County, TX | $102,600 |

| San Jacinto County, TX | $141,500 |

| San Patricio County, TX | $141,500 |

| San Saba County, TX | $104,700 |

| Schleicher County, TX | $127,700 |

| Scurry County, TX | $123,400 |

| Shackelford County, TX | $121,000 |

| Shelby County, TX | $102,600 |

| Sherman County | $121,900 |

| Smith County | $135,900 |

| Somervell County | $133,000 |

| Starr County, TX | $130,100 |

| Stephens County, TX | $131,400 |

| Sterling County, TX | $127,700 |

| Stonewall County, TX | $120,400 |

| Sutton County, TX | $127,700 |

| Swisher County | $116,900 |

| Tarrant County | $143,000 |

| Taylor County, TX | $123,400 |

| Terrell County TX | $118,500 |

| Terry, Texas | $129,000 |

| Throckmorton County, TX | $121,400 |

| Titus County | $132,300 |

| Tom Green County, TX | $129,200 |

| Travis County, TX | $144,100 |

| Trinity County, TX | $139,700 |

| Tyler County, TX | $105,700 |

| Upshur | $135,500 |

| Upton County TX | $121,400 |

| Uvalde County, TX | $145,000 |

| Val Verde County, TX | $142,000 |

| Van Zandt County | $130,000 |

| Victoria | $132,000 |

| Walker County, TX | $150,400 |

| Waller County | $151,200 |

| Ward County TX | $139,600 |

| Washington County, TX | $144,500 |

| Webb County | $120,600 |

| Wharton | $132,300 |

| Wheeler County | $120,500 |

| Wichita County, TX | $135,700 |

| Wilbarger County, TX | $125,800 |

| Willacy County | $130,300 |

| Williamson County, TX | $144,100 |

| Wilson County | $155,000 |

| Winkler County TX | $124,600 |

| Wise County, TX | $146,600 |

| Wood | $139,600 |

| Yoakum, Texas | $129,000 |

| Young County, TX | $135,700 |

| Zapata | $125,800 |

| Zavala County, TX | $141,800 |

Hire an attorney to help you understand your USDA loan income limits and property limits. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan and the different types of rural development income limits, and just trusting someone’s word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear on the USDA loan limits.

USDA First Time Home Buyer

A rural development loan is just another way of saying USDA mortgage. Both are in fact the exact same thing but different lenders use this terminology instead.

USDA home loans for rural housing are designed to keep agricultural areas in the United States strong by giving people in the communities the same opportunity to own homes even though there may be less homes in these USDA areas.

Our USDA loan experts will walk you through the process of obtaining a USDA loan in Texas, step-by-step.

With a USDA Loan you can:

- Purchase or refinance a home.

- Avoid high private mortgage insurance (PMI) like other loan programs.

- Avoid needing money for a down payment

- Get lower, fixed interest rates

- Save money and refinance an existing USDA loan into a lower fixed rate

And because it’s a USDA loan, lenders will offer you lower, more affordable rates. Even if you have less-than-perfect credit or are a first time home buyer a USDA loan could be the right loan for you.

Purpose

The USDA Rural Development Loan program is made to ensure that individuals of rural communities can compete in the global economy. This will allow for rural communities to build better community centers and facilities thus attracting more people to move to those neighborhoods. These loans are attractive to those who have stable income and credit, but don’t have enough money for down payment.

Benefit

Traditional mortgage loans can be more challenging for these types of buyers because they require a down payment and are unable to have a guarantee that the loan will be paid. USDA home mortgage loans on the other hand are insured and guaranteed by the government.

Protection

Under the Guaranteed Loan Program, the Housing and Community Facilities Program guarantees and insures loans made by lenders such as ourselves. In addition, an individual or family may borrow up to 100% of the appraised value of the home, which eliminates the need for a down payment.

Location

Not only people living in rural areas qualify. Those living in the outskirts of a city or in a medium sized town may also qualify. Find out if you qualify for a USDA home mortgage loan by asking questions without any obligations.

Outlook

USDA loans Texas are primarily designed to help low income individuals and households to purchase a home in rural areas. These loans do not require a down payment but do have income and property limitations.

If you are planning on purchasing a house and are a USDA first time home buyer, make sure your credit is in good standing. Most lenders want to make sure your credit history has been spotless for at least a year if you’re looking to get approved for a USDA first time home buyer loan. To obtain amazing rates for a USDA first time home buyer program, your credit score should be at least 600. Remember that the lower your score is, the harder the chances of getting approved if you are a first time home buyer USDA.

In addition to that, you can also take advantage of the USDA first time home buyer grant which helps.

USDA Refinance

If you are looking to refinance and want the best rate and terms, and want an easy process with more favorable guidelines, a USDA loan is probably the best choice for you.

USDA refinances are for rate and term refinance loans (no cash out allowed). The original loan must be a Guaranteed Rural Housing Loan.

USDA fixed rate loans are one of the most popular programs for refinancing. This is where you have stable predicable payments each month and as a result offers the most security for yourself and your family. If you are currently in an adjustable rate mortgage (ARM) and would like the security of a fixed rate, a fixed rate USDA is the right program for you.

Refinancing Your USDA Loan

Refinancing into a USDA loan is a very similar process to refinancing using conventional financing.

In fact, both loans require almost identical paperwork, it’s just that a USDA mortgage is only another type of loan.

That whole process generally takes no more than 30 days.

One nice advantage of refinancing is that you are allowed to skip one month of your mortgage payment after you close.

Depending on when in the month your mortgage closes you can possibly not make the current mortgage payment and skip the following month as well. You can use this money to pay off another bill, fix up your home, or even go on vacation.

When it comes to refinancing your current Texas USDA mortgage, we make the process simple by giving you straight forward advice because we know that this will enable you to make the most accurate financial decision.

Check out the interest rates for 30, 15 and 20 year term lengths if looking for a USDA refinance. Many times the shorter the term length the lower the interest rate. Although you may think you payment will be higher on a shorter term loan on perhaps double wide financing, you can actually save money on your payment by choosing a lower interest rate and a shorter term on the USDA streamline refinance.

USDA Mortgage Insurance

Although using money given to you as a gift from relatives for your down payment is legal, make sure to document that the money is a gift. The lending institution may require a written statement from the documentation and donor about when the deposit to your bank account was made. Have this documentation ready for your lender if you’re looking for a home loans direct.

USDA Underwriting Guidelines

To be eligible, applicants must:

- Have an adequate and dependable income.

- Be a U.S. citizen, qualified alien, or be legally admitted to the United States for permanent residence.

- Have an adjusted annual household income that does not exceed the moderate income limit established for the area. A family’s income includes the total gross income of the applicant, co-applicant and any other adults in the household. Applicants may be eligible to make certain adjustments to gross income— such as annual child care expenses and $480 for each minor child—in order to qualify. Here is an automated USDA income eligibility calculator for USDA to help out.

- Have a credit history that indicates a reasonable willingness to meet obligations as they become due.

- Have repayment ability based on the following ratios: total monthly obligations / gross monthly income cannot exceed 41%.

When comparing USDA direct vs guaranteed loans in 2024 and before giving personal information to any lender, check with your local Better Business Bureau. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

USDA Property Eligibility

Before you set out and start making offers on USDA homes, you need to know what areas are going to work and which one’s aren’t. While there are some rules that are set in place and general USDA maps that can help guide you as to what home fall under these USDA eligible areas, you’d be surprised to know that we have seen some homes that we’d never thought would be considered “rural”.

Eligible USDA property types include single family homes and condominiums (primary residence only).

Since the USDA loan program is designed for areas that are in rural areas, here are some of the rules that must be met for existing homes:

- New or Existing Homes – Guaranteed loans can be made on either new or existing homes. All existing homes must be structurally sound, functionally adequate, and in good condition. There are no restrictions on the size or design of the home financed.

- Home Cannot Be Income Producing – The home cannot be used for income-producing purposes; aka Farm or Ranch agricultural exempt properties.

- Location – Homes must be located in rural areas. Rural areas include open country and places with a population of 10,000 or less and—under certain conditions—towns and cities with between 10,000 and 25,000 residents. While this rule is very much like a blanket policy, you would be very surprised about which homes qualify, so it’s always a good idea to check with us before you count any homes out of the picture.

If any of this is confusing or you have a question, please feel free to reach out and we’ll do our best to help you.

USDA Approved Lenders

Put as much as you can toward a down payment. Twenty percent is a typical down payment, but put down more if possible. Why? The more you can pay now, the less you’ll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars.

Pay off or lower the amount owed on your credit cards before applying for a USDA rural loan with USDA approved lenders. Although your credit card balances do not have to be zero, you should have no more than 50 percent of the available credit charged on each credit card. This shows lenders that you are a wise credit user when trying to get approved with USDA mortgage lenders.

USDA Mortgage Calculator

Calculating your mortgage payment can be confusing if you’re not sure what you should be adding, and what you should be subtracting.

While there is a general rule that you can always take 1% of your sales price as your mortgage payment, we wanted to take it one step further and made a USDA loan calculator specifically for you to help you figure out what your monthly payment will be.

All you have to do is plug in a just 2 numbers and everything will get automatically calculated for you.

It’s really easy.

USDA Loan Rates

Getting a great USDA rate is important when looking to buy or refinance a home.

The thing that many people don’t realize is how mortgage rates actually work.

While it’s always best to get a fresh, up to date rate quote, it’s a good idea to know a “range” of what rates are doing in the market so that you’ll at least know where things stand.

Keep in mind that rates always change, but knowing the trends can help you get an idea as to where USDA rates stand at the moment.

To see the average USDA mortgage rates for Texas, just click here.

Also, here’s a great video that goes over how mortgage rates work and why they sometimes go up, and why they go down as well:

USDA Loans Texas

If you have just started a new job within the last year, do not embark on the process of buying a home for a USDA loan Texas. The best home mortgage rates go to those that have been with a company for a number of years. Having a job for a short time is seen as a risk, and you will be the one to pay for it with a higher interest rate.

A USDA home loan Texas can be a great thing once you can get qualified.

Credit Score For USDA Loan

Know that Good Faith estimates are not binding. These estimates are designed to give you a good idea of what your mortgage will cost on your home loan direct. It should include title insurance and points, and appraisal fees. Although you can use this information to figure out a budget, lenders are not required to give you a mortgage based on that estimate.

Learn about fees and cost that are typically associated with a home mortgage. There are so many strange line items when it comes to closing on a home. It can be a little bit discouraging. But with a little homework, you can talk the language, and this will make you better prepared to negotiate.

USDA Loan Process

Put as much as you can toward a down payment. Put down more if possible, even though twenty percent is a typical down payment. Why? The more you can pay now, the less you’ll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars on your direct home loan.

USDA Loan Status

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. By seeking out credit at a lower interest rate to consolidate smaller debts, you may benefit. Having your financial house in order will give you some leverage to get the best terms and rates.

USDA vs FHA

When comparing the USDA direct vs guaranteed loan program and FHA, you should contact your credit bureau if you find incorrect information on your credit file. There are so many instances of identity theft happening each year. For this reason, most credit bureaus have risk managers that have experience dealing with this type of thing. Also, the credit bureau can mark your credit report as one that has had their identity stolen.

USDA Appraisal Guidelines

Speak with a broker and ask them questions about things you do not understand on USDA appraisal guidelines. It is essential that you know exactly what is happening on your USDA appraisal. Be sure the broker has your contact information. Check your emails to see if the broker needs more information when you get your USDA appraisal requirements back.

USDA Mortgage Lenders

Always read the fine print when seeking a USDA home loan pre approval and even on double wide financing. If you have a hard time understanding the information, get some help with an expert that does not work for the lending company for a USDA home loan Texas. You want to make sure that the USDA home loans in Texas terms do not change after a certain amount of time. The last thing you want is surprises.

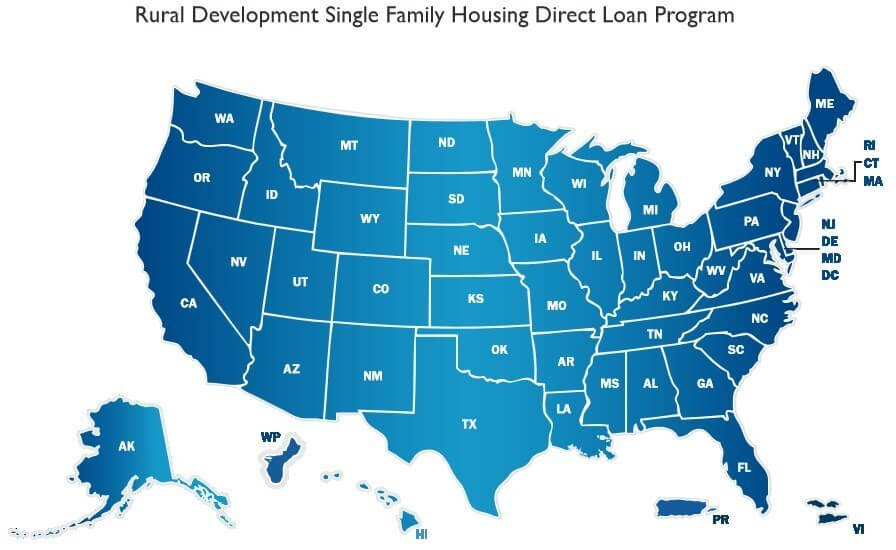

USDA Financing Map

USDA Home Loans Texas

Take note of home buying season. Usually markets will have cold and hot selling periods if you’re looking for a USDA home loan pre approval. The hotter the selling period, the more shady lenders are likely to be around. If you know what trend the market is in on double wide loans, you will better be able to guard against people looking to take advantage of you.

USDA Loan Closing Costs

Check the internet for mortgage financing. You don’t have to get a mortgage from a physical institution anymore. Lots of solid lenders operate entirely online. These loans are often processed quicker and they’re decentralized.

USDA Loan Reviews

Most financial institutions require that the property insurance and taxes payments be escrowed. This means the extra amount is added onto your monthly mortgage payment and the payments are made by the institution when they are due. This is convenient, but you also give up any interest you could have collected on the money during the year.

Now that you know what it takes to get a mortgage which fits your needs, you have to get down to work and do it. Follow the steps laid out here and begin your planning process. Soon enough, you’ll find a great lender who is offering a great rate and your job will be done.